Opinion: A budget proposal tells you how the GOP rates crime, cops Los Angeles Times

Table Of Content

Buyers are still out there, but for many their affordability is much reduced due to higher mortgage rates. Annual house price growth has ground to a halt, with prices falling by 0.1% in the year to September, down from the revised 0.8% growth in the 12 months to August, writes Jo Thornhill. Despite fewer buyers in the market, sales are 15% higher than a year ago and 5% higher than in 2019, before the pandemic.

February: Halifax Sees Prices Stabilise After Recent Falls

The average interest rate on Rightmove’s mortgage monitor for a five-year fixed rate deal at 85% loan-to-value is 5.69% – up by 0.49 percentage points compared to this time last month. However, agents are reporting that competitively-priced homes priced are still attracting buyers due to a shortage of property for sale. Aberdeen saw the largest drop in the 12 months to June, however, with average asking prices shrinking 1.6%. A handful of locations – with many clustered in the South of Englnd where average prices tend to be higher – experienced price declines in the year to June. Buying patterns are also shifting towards smaller properties, with the sale of three and four bedroom homes down 41% in the last two months, compared with the same period in 2018. The average UK house price as measured by the ONS now stands at £288,000, which is £5,000 higher than a year ago, but £5,000 below the peak in prices seen in November 2022.

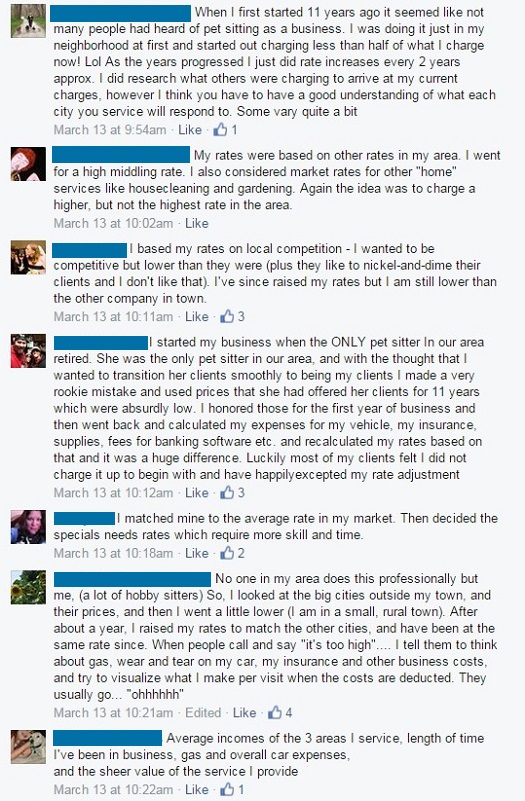

Average House Sitting Rates

“It is likely to feel very frenetic for those taking out a mortgage right now, as they try to quickly lock in the best rate that they can find. The official Bank Rate is expected to rise from 4.5% to 4.75% when the Bank of England’s Monetary Policy Committee meets on Thursday, in a bid to tackle high inflation. Rightmove research shows that sellers who are over-ambitious with their pricing, only to have to reduce their asking price later, have a 10% less chance of selling than those who price more realistically from the outset.

Ratings for house sitters listed on Care.com

This may cause you to reconsider, or it may cause you to expand your parameters for housesitting. Since you are just starting out, you are not likely to be offered money for a housesitting job right away, but this is a good opportunity to get referrals and experience. Before you start packing your bags, here’s what you need to know about housesitting jobs. Often, housesitting jobs include more than just sitting around in someone else’s house. Most often, additional duties include caring for pets and plants, although they can include maintenance and cleaning, too. For example, you may be providing them with kitchen, WiFi, and swimming pool access, which allows the sitter to enjoy their stay.

April: Sellers Emboldened By Rising Demand

While the annual rate of house price inflation eased from 11% in July to 10% in August, this was the 10th successive month of double-digit growth. While house prices continue to rise in 2022 — albeit at a slowed rate — Zoopla expects them to decline in 2023, particularly in more expensive regions such as London and the South East. The East of England was among the regions least affected by annual price falls, with a growth rate of 5.5% to December compared to 7.2% in November. The figures point to a cooling of the housing market at the end of last year in the wake of the Liz Truss/Kwasi Kwarteng mini-Budget in September, which rocked market confidence and led to an increase in mortgage rates.

How Much Does Dog Sitting & Boarding Cost in Australia? 2024 Price Guide – Dogster - Dogster.com

How Much Does Dog Sitting & Boarding Cost in Australia? 2024 Price Guide – Dogster.

Posted: Wed, 20 Mar 2024 07:00:55 GMT [source]

A Huge Number of Homeowners Have Mortgage Rates Too Good to Give Up

But the East of England saw the lowest rate of annual growth with a drop of 1.6% (average house price in the region is £351,000). While annual house price inflation is down in 12 out of the 20 cities where data is recorded by Zoopla, some areas appear to be more resilient than others. The south east of England has experienced the biggest house price falls at 6% over the past year, the average house price for the region is £374,066. London’s average property price remains the highest in the UK at £537,000, despite annual price falls of 1.1% in the 12 months to September.

House Sitting in Portugal - How to Live in Portugal For Free -... - Portugalist

House Sitting in Portugal - How to Live in Portugal For Free -....

Posted: Wed, 20 Dec 2023 08:00:00 GMT [source]

Housesitters can find job offerings and contact the homeowners who have a listing that works for them. They can choose between homeowners looking for free housesitting services and those who are willing to pay. While it is possible to get a first-time housesitting job, the competition for such positions is fierce. There are a lot of people who like the idea of living for free in someone else’s home. Housesitting is a gig that could provide you with weeks or even months of free housing.

“As we move through 2023, that trend is likely to continue as higher borrowing costs lead to reduced demand. The first-time buyer sector is demonstrating the strongest signs of recovery, said Rightmove, with numbers down by just 7% in February compared to the same month in 2019. There is still a shortage of property for sale, with numbers down by 11% in February compared to 2019. However, volumes are continuing to recover – from 15% down at the start of the year, and 30% down in the aftermath of the mini-budget in September. Online property website Rightmove says asking prices were almost flat in February, confounding expectations that values would fall, writes Laura Howard.

November: Mortgage Borrowing Plummets In Wake Of Stamp Duty Change

The mortgage lender says average prices grew by 1.4%, or £3,860, in March – the largest month-on-month increase since September last year. A separate report from estate agents Hamptons, has found that a record proportion of UK homes are being bought by buyers without a home to sell. The average price of a UK home hit a record level for the third month in a row in April 2022, according to data from property portal Rightmove. Zoopla reports that prices in the south west of England also achieved a double-digit return, up by 10.6% in the year to March. “With the rising cost of living not looking to dissipate any time soon, the fact this is also likely to result in further interest rate rises is something of a double whammy.

Its house price index shows asking prices growing 1.6% month-on-month, or £5,537, bringing the average property price to £360,101 in April. Regionally, the largest annual rises in June were recorded in Northern Ireland where the average property price increased by 15.2% to £187,833. This was followed by Wales, where prices now stand at £219,281, a rise of 14.3%. The figures – which, unlike other house price indices, are based on completed sales data and not mortgage approvals or asking prices – put the average cost of a UK home at £283,000 in May. Earlier this August, property data from Halifax, one of the UK’s largest mortgage lenders, also recorded a recent fall in average UK house prices.

Levels are just 1% under the pre-Covid figures for March 2019, and above those seen in September before they plummeted by 21% following the mini-Budget. Rents have continued to rise sharply which has pushed more first-timers on to the property ladder. Today has seen the launch of a 100% loan aimed at renters by Skipton building society. Mr Bannister added that steadying mortgage rates and a more positive outlook for the economy were also contributing to an improvement in seller confidence. The 1.8% rise recorded for this month is higher than the historic average rises seen by Rightmove each May, which tend to be around 1%. You can read more about how the market’s various house price indices are calculated in my analysis.

It added that more people moved into a new property in June than in any other month since 2005, when records began for this data. The ONS said that the latest annual growth figure was a slight increase on the 9.8% recorded a month earlier in October. Average UK house prices soared by 10% in the year to November 2021, according to the latest figures from the Office for National Statistics (ONS). Rightmove said that, regionally, the East Midlands, South East, South West, Wales and Yorkshire & Humber each recorded a rise of 10% or more in new properties for sale this January compared with the same month last year. The announcement, the first back-to-back interest rate rise since 2004, will see the cost of lending rise, including an automatic increase in tracker mortgage rates. The news also means dearer home loans for customers with standard variable rate mortgages, if their lenders choose to pass on the increase.

And yet, the rhetoric from House Republicans across the country from New York to California tells a completely different story. HMRC estimated the provisional non-seasonally adjusted figure for UK residential transactions in July 2021 at 82,110. The fall coincided with the tapering of a temporary, pandemic-enforced reduction in Stamp Duty Land Tax at the end of June in England and Northern Ireland.

Its next decision will be announced on 14 December, when another ‘hold’ is widely expected, with the rate expected to fall in 2024. Prices rose marginally month-on-month – by 0.2% – in November, the third successive monthly increase. “In reality, the fall has been around half that, or less in some regional cities like Bristol, where roughly two-thirds of properties on the market in certain postcodes are currently under offer. House prices across the UK are 1.8% lower than December 2022, according to Nationwide building society – that’s 4.5% lower than their all-time peak in the summer of that year.

Comments

Post a Comment